Options 101: A Fun & Relaxed Guide to Boosting Your Investment Safety with Options 🚀🛡️

- Lox

- Feb 7, 2025

- 4 min read

Hey there, future savvy investor!

Welcome to your crash course on using options to make your investment portfolio safer, smarter, and yes – even a bit more fun.

Today, we’re breaking down four beginner-friendly option strategies – Covered Calls, Protective Puts, Collars, and Cash-Secured Puts – and illustrating each with simple data visualizations. Grab your favourite beverage, settle in, and let’s chat about calls, puts, and how they can be your portfolio’s safety features. 💪

What Are Options? Let’s Demystify the Basics

Imagine you have a special coupon that lets you buy or sell something at a fixed price before a set date – but you’re not forced to use it if you don’t want to. That’s pretty much what an option is in the investing world. There are two main types:

Call Options: They give you the right to buy a stock at a set price (the strike price) before the option expires. Think of it like having a VIP pass to snag concert tickets at a fixed price, even if they later sell for way more. 🎫🎉

Put Options: These give you the right to sell a stock at a specific price by the expiration date. It’s like having an insurance policy for your prized vintage comic book – if its value drops, you can still sell it at the insured price. 🛡️📉

Every option has three key parts:

Strike Price: The agreed price at which you can buy (with a call) or sell (with a put).

Expiration Date: The “use-by” date for your coupon.

Premium: The fee you pay for the option – like a small ticket price for the chance to use that coupon.

Strategy Spotlight: Covered Calls 😃💰

Covered calls are like renting out your stocks for extra cash. You own a stock and sell a call option on it. In exchange for the premium (income), you agree to sell your shares at a set strike price if the option is exercised. This strategy is ideal if you think the stock will stay relatively flat or rise only modestly.

What this shows:

The stock-only line climbs continuously as the stock price increases.

The covered call line starts a bit higher (thanks to the premium) but flattens once the stock reaches the strike price (capping your upside).

On the downside, both lines fall—but the covered call’s loss is slightly cushioned by the premium received.

Strategy Spotlight: Protective Puts 🛡️👀

Protective puts are like buying insurance for your stock. You own the stock and purchase a put option on it. This put guarantees you a minimum selling price (the strike), so if the stock drops sharply, you can still sell at that price—limiting your loss. Think of it as a safety net!

What this shows:

Upward movement remains similar to the stock-only scenario (except for a slight dip due to the cost of the put).

On the downside, the protective put creates a flat “floor” at the strike price—no matter how low the stock falls, your loss is capped.

Strategy Spotlight: Collars – Risk and Reward Comparison 🎭

A collar strategy combines both a protective put and a covered call on the same stock. With a collar, you protect against large losses (with the put) while capping your gains (with the call). It’s like putting guardrails around your investment outcomes.

What this shows:

The stock-only approach has unlimited upside but also huge downside risk.

The collar strategy limits both the upside and the downside—providing a more balanced, predictable outcome.

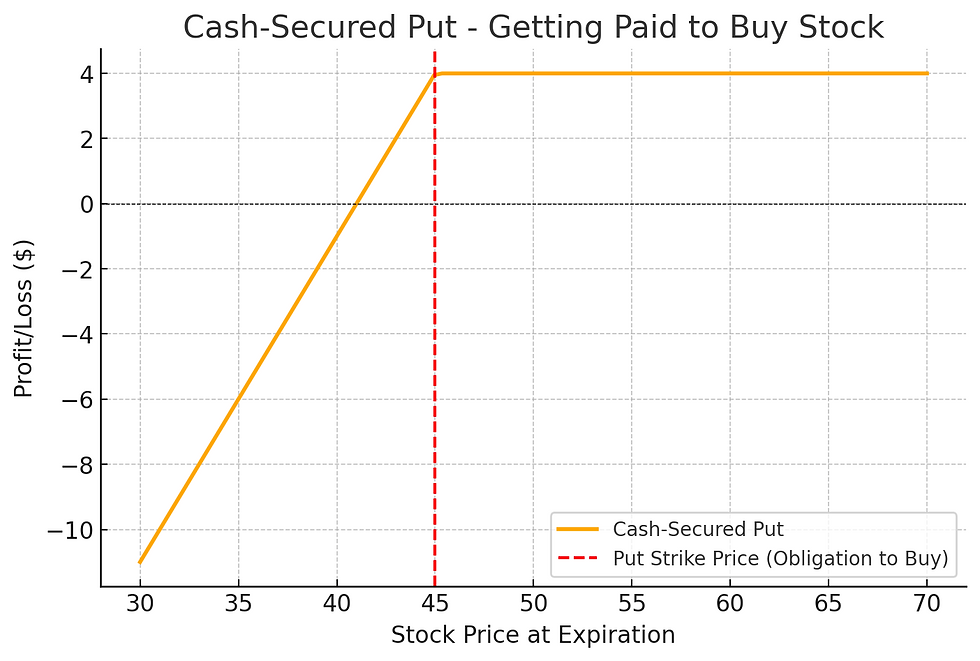

Strategy Spotlight: Cash-Secured Puts – Income Generation & Risk 💰⚖️

With cash-secured puts, you sell a put option on a stock you wouldn’t mind owning. You set aside enough cash to buy the stock if the option is exercised. This strategy lets you earn a premium right away, giving you extra income, while agreeing to purchase the stock at a lower price if it falls.

What this shows:

By selling puts, you earn immediate income (the premium).

You’re committed to buying the stock at the strike price, so if the stock falls, your loss is limited to the difference between the strike and the premium received. This makes the strategy appealing if you’re comfortable owning the stock at that price.

Wrapping It Up: Options as Your Safety Net 🎉

Options might sound intimidating, but these strategies can be your best friends when it comes to managing risk and generating extra income in your portfolio. Whether you’re using covered calls to earn extra cash, protective puts as insurance, collars to balance your risk and reward, or cash-secured puts to get paid for waiting to buy, you’re taking a proactive approach to safeguard your investments.

Remember:

Covered Calls boost income but cap your upside.

Protective Puts shield you from major losses.

Collars set defined boundaries for both gains and losses.

Cash-Secured Puts let you earn while waiting to buy a stock at a lower price.

With these visualizations and explanations, you now have a clearer picture of how each strategy works. Happy investing – may your portfolio be as safe as possible in turbulent times! 🚀🛡️💰

![~DUBAI~ Investment Boom and The Attraction of Global [& Australian] Capital](https://static.wixstatic.com/media/1a04c9_d1e3f78cde804f4c82f580a783e0bc98~mv2.png/v1/fill/w_980,h_386,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/1a04c9_d1e3f78cde804f4c82f580a783e0bc98~mv2.png)

Nice good explanation. Hate it when my covered calls get called away ... Whats best strategy when you are itm?